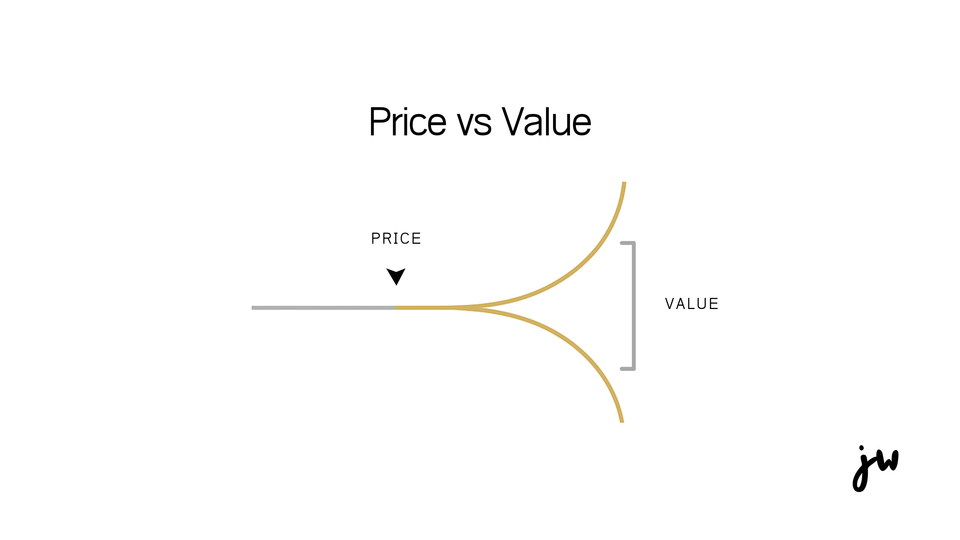

Price Vs Value

Price Is What You Pay. Value Is What You Get.

In a world flooded with price tags, limited-time deals, and discount culture, Warren Buffett’s timeless advice stands as a clear-eyed reminder of what matters:

“Price is what you pay. Value is what you get.”

It’s a simple phrase—almost too simple. But beneath its surface lies one of the most important distinctions in investing, business, and life itself.

The Confusion Between Price and Value

Let’s break it down.

- Price is the number on the tag.

- Value is the benefit, utility, satisfaction, or transformation you receive.

These two things are not always aligned.

You might buy a $2 bottle of water at a gas station that quenches your thirst on a scorching day—that’s high value at low cost.

Or you might buy a $700 designer jacket that sits in your closet all year—high price, low value (to you).

Buffett’s philosophy urges us to go deeper than the surface. Don’t ask “How much does it cost?” Ask “What am I actually getting in return?”

In Investing: Why Value Matters More Than Price

Buffett is, of course, most famous as one of the greatest investors of all time. His approach is rooted in value investing—buying stocks not because they are trendy or cheap, but because their intrinsic value exceeds their current market price.

His logic?

If you buy a business for $80 that’s actually worth $120 based on its fundamentals, you’re getting $40 of value for free.

Price is temporary and driven by emotion. Value is long-term and based on fundamentals.

This is why Buffett famously avoids hype. He’s not impressed by bubbles, noise, or what’s “hot.” He cares about what the asset is truly worth—and whether it's currently being sold at a discount.

In Business: Value Drives Loyalty

The same principle applies in how you sell.

Businesses that obsess over cutting prices often race to the bottom. But the most successful brands compete not on price—but on value.

Think Apple. Their products are rarely the cheapest. But people still pay because they associate them with design, simplicity, innovation, and experience. That’s value.

Buffett himself once said:

“The best business is a royalty on the growth of others, requiring little capital.”

He looks for moats—companies that provide enduring value that customers will keep coming back for, even if the price isn’t the lowest.

In Life: Invest in Value-Generating Choices

The principle transcends money.

- A $20 book that changes your mindset has far more value than a $200 night out that leaves you empty.

- A friend who shows up when you’re struggling offers more value than 100 social media followers.

- A coach, mentor, or therapist might cost something—but the transformation can be priceless.

Buffett’s advice challenges us to become more intentional.

Instead of:

💭 “What’s the cheapest option?”

Try:

💭 “What’s the best long-term decision with the highest return on value?”

How to Apply This Philosophy

Here are some practical ways to live by Buffett’s principle:

✅ Think long-term – Don’t be fooled by short-term costs or savings. Ask: Will this still matter to me in 5 years?

✅ Identify real ROI – What are you gaining in skills, peace of mind, quality, or relationships?

✅ Be wary of underpricing – If something seems too cheap, ask what’s being compromised—quality, ethics, longevity?

✅ Invest in quality over quantity – Fewer things that matter > more things that don’t.

✅ Know your personal definition of value – It’s not the same for everyone. What’s valuable to you might not be to someone else—and that’s okay.

In a culture obsessed with chasing deals, speed, and surface-level wins, Warren Buffett’s philosophy is a call to slow down and think deeper.

Don’t just ask, “Can I afford this?”

Ask, “Is this worth it?”

Because in the end, price is just a number. But value shapes your life.

Subscribe to our newsletter.

Become a subscriber receive the latest updates in your inbox.

Member discussion