In a world that rewards enthusiasm, flexibility, and being a “team player,” saying yes can feel like the fastest way to get ahead—socially, professionally, and even emotionally. But there’s a darker side that many people don’t realize until it’s too late: saying yes to everything can quietly but powerfully sabotage your financial health.

Let’s break down how:

1. The Fear of Missing Out (FOMO) Becomes Expensive

Whether it’s a spontaneous dinner, a last-minute trip, or the latest gadget your friends are raving about—FOMO is real. And every “yes” in the name of not being left out drains your wallet little by little.

Real cost: Saying yes to every social event or group expense can add hundreds or even thousands to your monthly spending without adding meaningful value to your life.

2. People-Pleasing Leads to Overcommitting Financially

Many people struggle with saying no because they don’t want to let others down. This means buying gifts you can’t afford, donating beyond your means, or agreeing to split costs that stretch your budget.

Example: You don’t want to seem “stingy” in front of colleagues, so you chip in for a group vacation you weren’t prepared for. Your credit card balance takes the hit—and so does your peace of mind.

3. Lifestyle Inflation Creeps In

Each “yes” to brunch, subscriptions, upgrades, and extras piles onto your lifestyle. As income increases, so do the yeses—and so does the spending. But if your expenses are growing faster than your savings, you’re digging a financial hole in style.

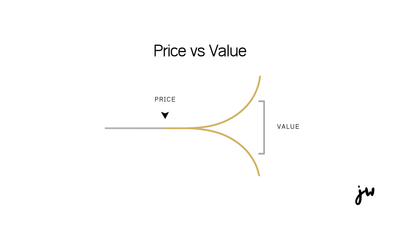

Lesson: It’s not how much you earn. It’s how much you keep.

4. No Budget Survives Endless Yeses

A well-made budget is only as strong as your ability to stick to it. Every unplanned yes—whether it’s eating out again or buying something “just this once”—chips away at your discipline and derails your financial plan.

Without limits, even a great plan becomes meaningless.

5. You Sacrifice Long-Term Security for Short-Term Approval

Saying yes gives immediate rewards—praise, smiles, inclusion. But at what cost? Your emergency fund, your savings goals, your investments, and even your debt repayment take the hit. You're saying yes to everyone else’s needs while saying no to your future self.

So What Can You Do Instead?

Here’s how to regain control:

- Set Financial Boundaries: Define how much you’re willing to spend on social outings, gifts, and extras each month—and stick to it.

- Pause Before You Say Yes: Buy yourself time. Say, “Let me think about it and get back to you.” This small delay helps align your decisions with your budget and values.

- Learn to Say No Graciously: Saying no doesn’t make you selfish—it makes you responsible. A polite “I’m saving up for something important right now” is often enough.

- Budget for Spontaneity: You don’t have to cut out fun. Just plan for it. Create a “Yes Fund” so you can say yes guilt-free when it really matters.

Final Thoughts

Saying yes might feel like you’re living life to the fullest—but unchecked, it could be costing you your financial freedom. Start honoring your values over your impulses. Because sometimes, the most powerful thing you can say for your future… is no.

Become a subscriber receive the latest updates in your inbox.

Member discussion